Just some notes, findings and tips from my workshop.

Never knew what %% does. It gives the mode…

7 %% 2## [1] 1Exponetial smoothing

Straight line through the data….

forcast packge defaults to Akaike’s Information Criterion (AIC) for it’s selection…

Some tools that my tutors made:

setwd("/Users/rosseji/Dropbox/TrendLock/ISF/forecasting with R/")

# Load the three time series, as before

ts1 <- ts(scan("ts1.txt"), start=c(2011,1), frequency=4)

ts2 <- ts(scan("ts2.txt"), start=c(2011,1), frequency=12)

ts3 <- ts(scan("ts3.txt"), start=c(2011,1), frequency=12)

# Let us store the time series to be explored in variable `y' so that we can

# repeat the analysis easily with new data if needed.

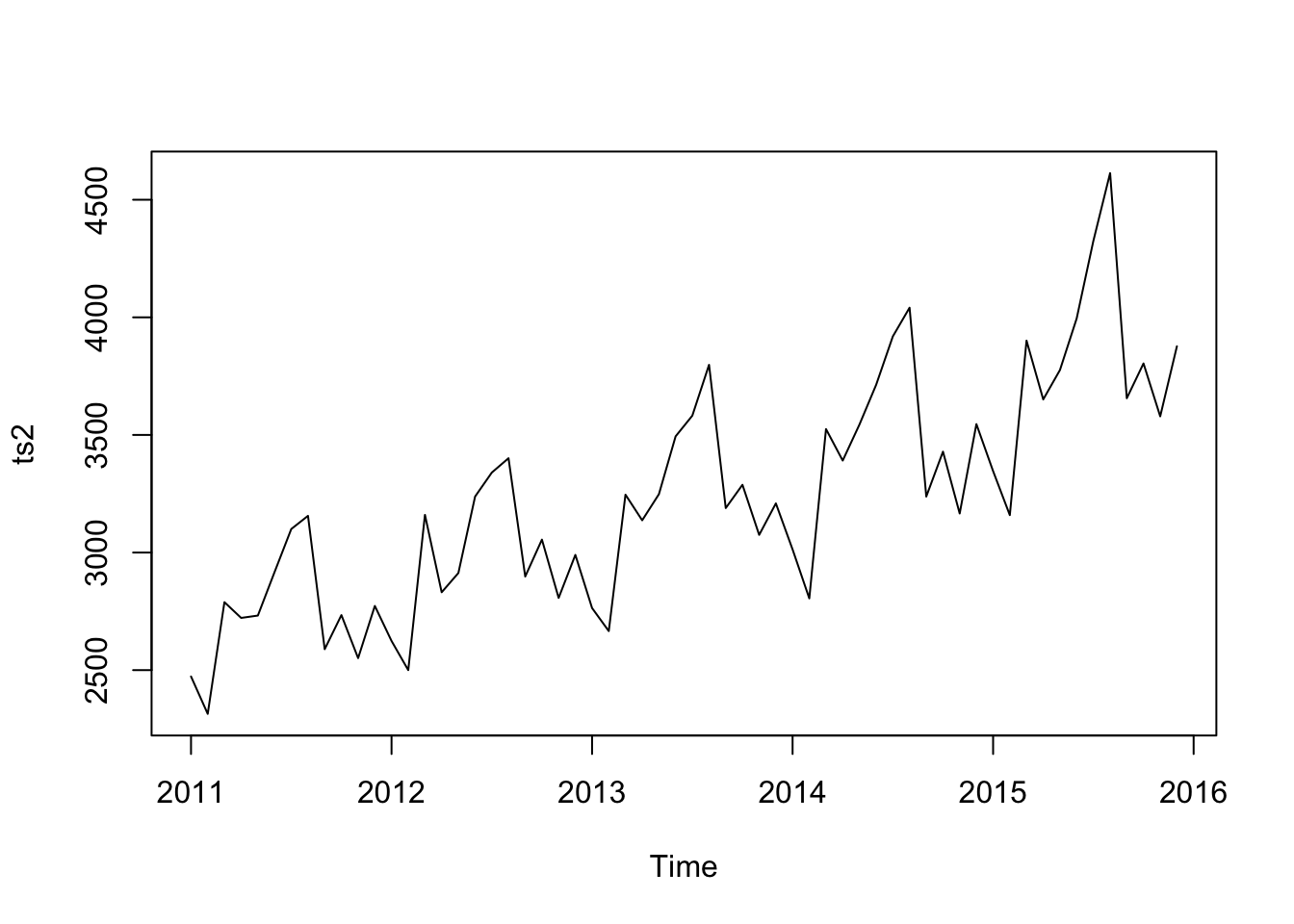

y <- ts2

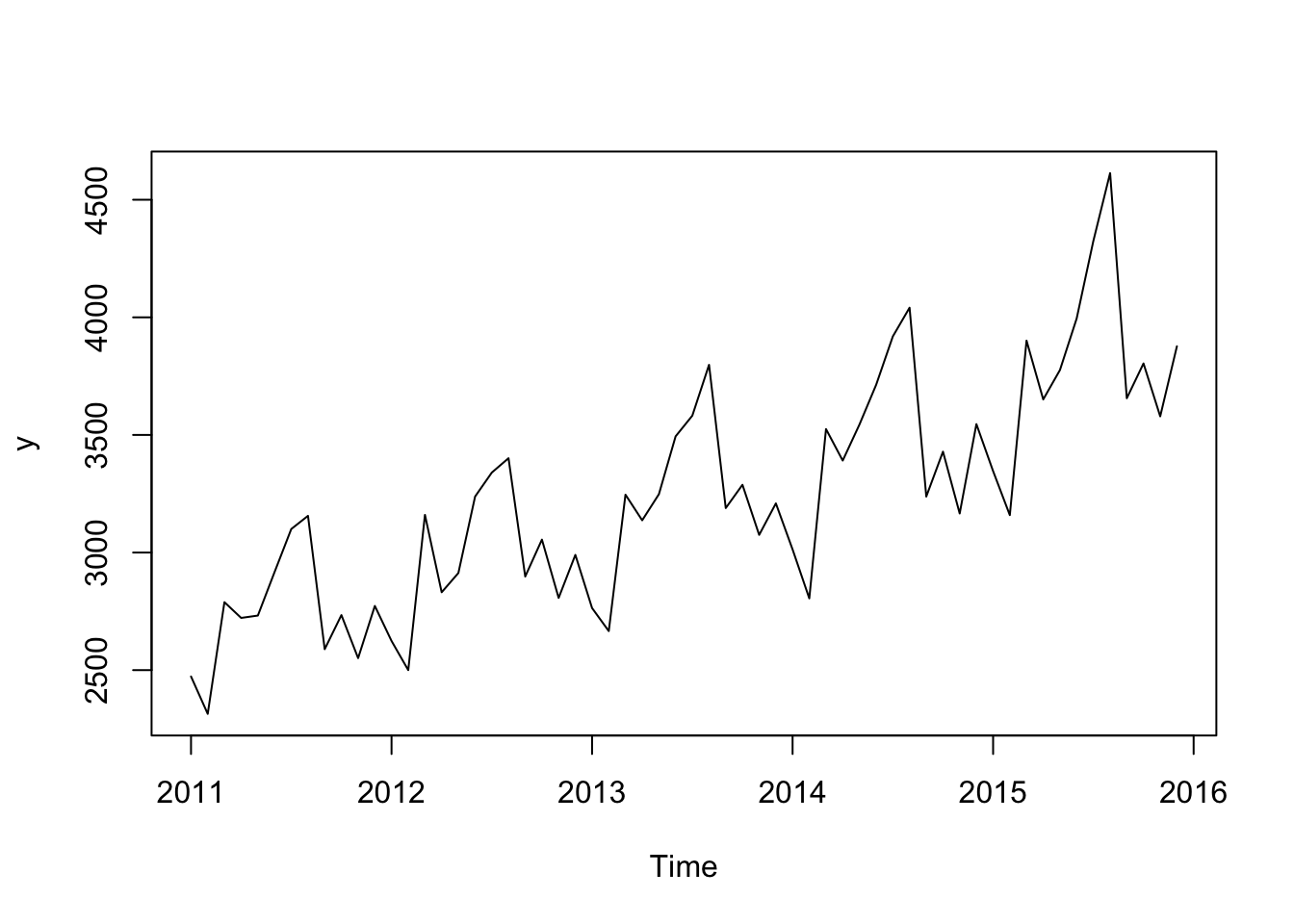

# First we plot the series to get a general impression

plot(y)

# ----- Trend -----

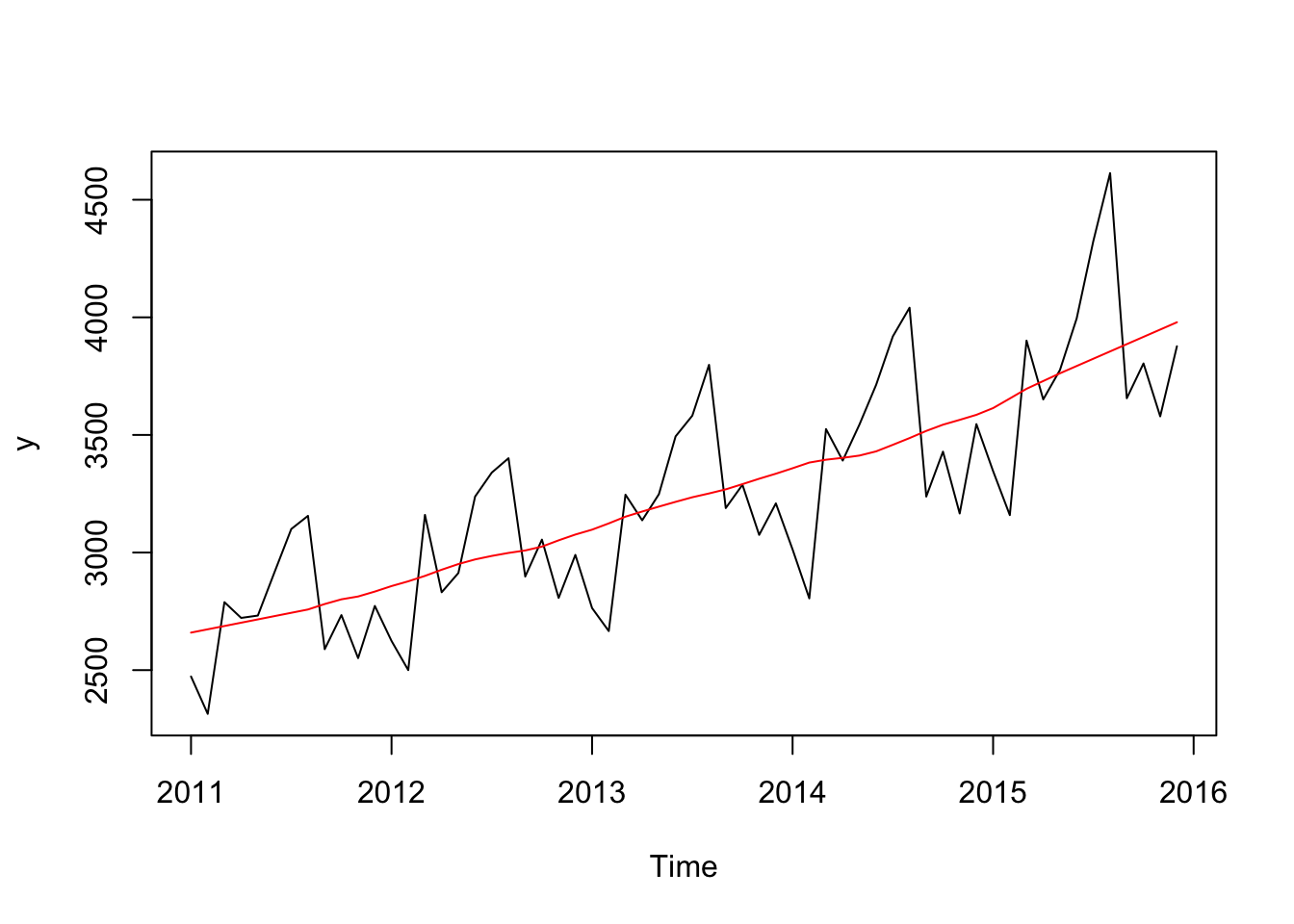

# Let us look for trend in the data, by calculating the Centred Moving

# Average

cma <- cmav(y, outplot=1)## Model is being refit with current smoothing parameters but initial states are being re-estimated.

## Set 'use.initial.values=TRUE' if you want to re-use existing initial values.print(cma)## Jan Feb Mar Apr May Jun Jul

## 2011 2659.533 2673.576 2687.619 2701.662 2715.705 2729.748 2743.792

## 2012 2857.417 2877.625 2900.708 2926.958 2951.000 2970.708 2985.583

## 2013 3097.250 3123.875 3152.542 3174.375 3195.250 3215.542 3235.042

## 2014 3358.375 3382.542 3394.708 3402.625 3412.292 3430.125 3458.042

## 2015 3614.167 3654.917 3696.167 3729.208 3762.042 3793.042 3824.042

## Aug Sep Oct Nov Dec

## 2011 2757.833 2781.042 2801.042 2813.125 2834.042

## 2012 2998.333 3008.833 3025.167 3051.875 3076.500

## 2013 3251.208 3268.625 3290.833 3313.750 3335.208

## 2014 3486.667 3517.083 3543.583 3564.083 3585.500

## 2015 3855.042 3886.042 3917.042 3948.043 3979.043cmav(y, outplot=1, fill=T)## Model is being refit with current smoothing parameters but initial states are being re-estimated.

## Set 'use.initial.values=TRUE' if you want to re-use existing initial values.

## Jan Feb Mar Apr May Jun Jul

## 2011 2659.533 2673.576 2687.619 2701.662 2715.705 2729.748 2743.792

## 2012 2857.417 2877.625 2900.708 2926.958 2951.000 2970.708 2985.583

## 2013 3097.250 3123.875 3152.542 3174.375 3195.250 3215.542 3235.042

## 2014 3358.375 3382.542 3394.708 3402.625 3412.292 3430.125 3458.042

## 2015 3614.167 3654.917 3696.167 3729.208 3762.042 3793.042 3824.042

## Aug Sep Oct Nov Dec

## 2011 2757.833 2781.042 2801.042 2813.125 2834.042

## 2012 2998.333 3008.833 3025.167 3051.875 3076.500

## 2013 3251.208 3268.625 3290.833 3313.750 3335.208

## 2014 3486.667 3517.083 3543.583 3564.083 3585.500

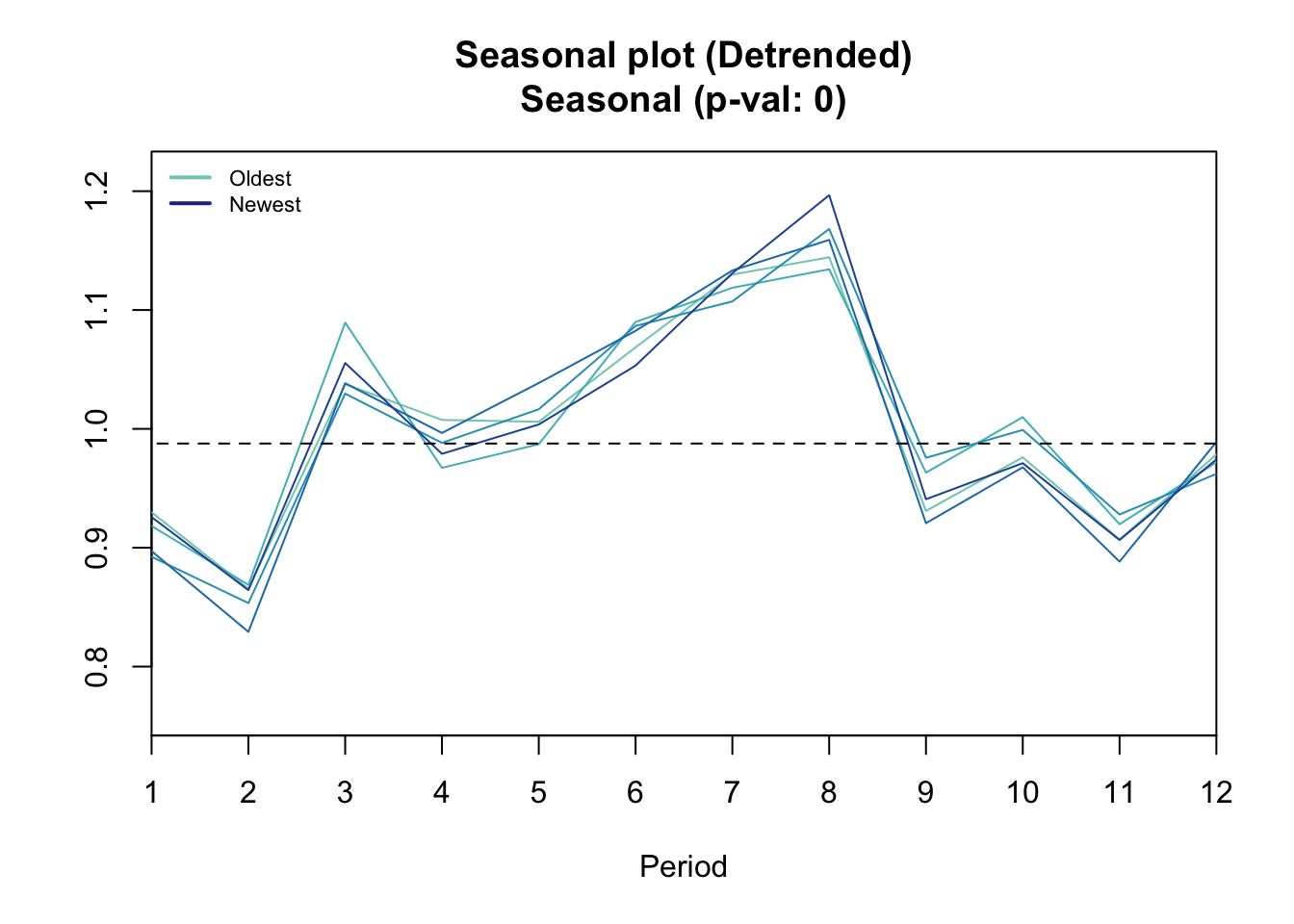

## 2015 3855.042 3886.042 3917.042 3948.043 3979.043#Seasonality

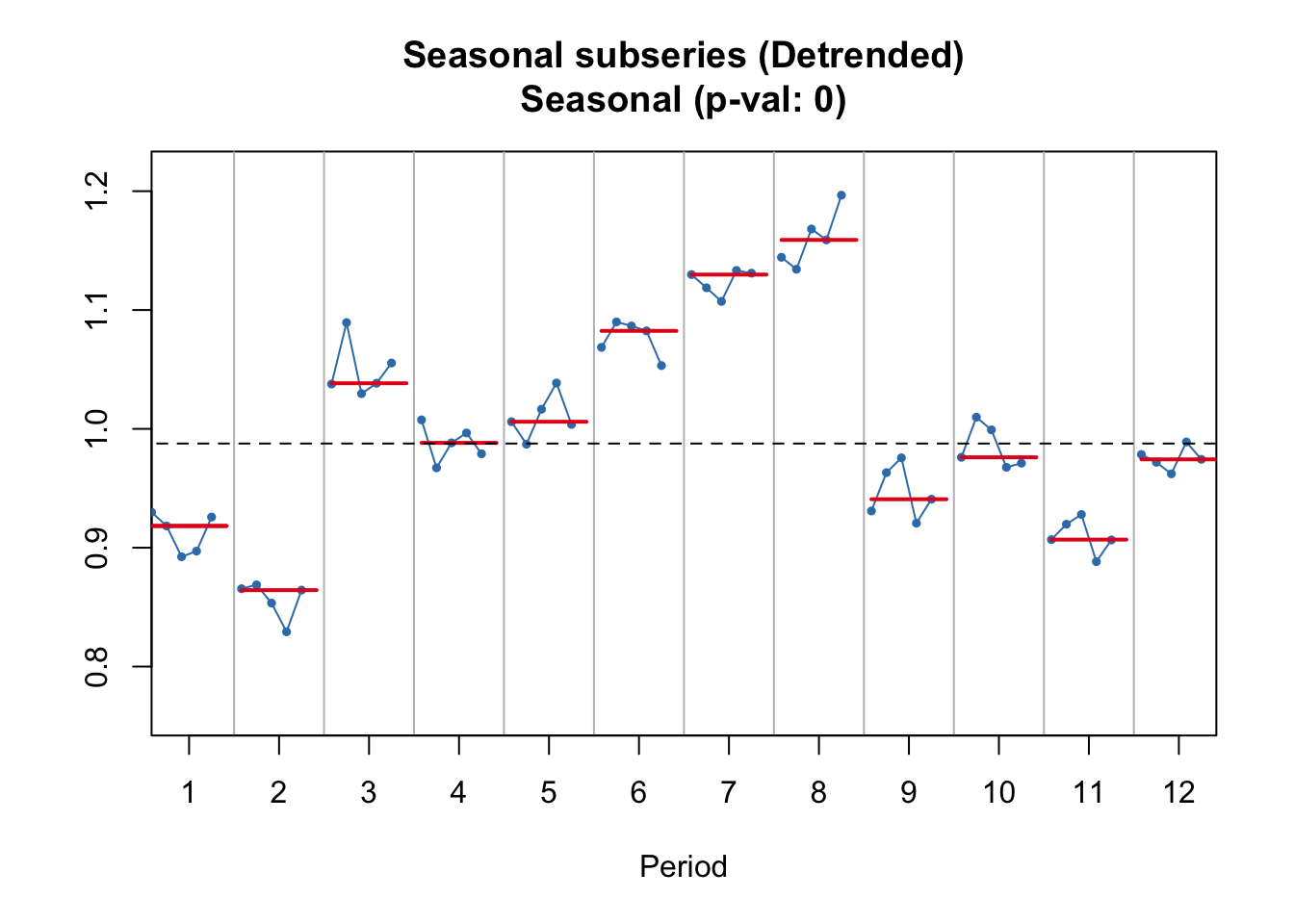

seasplot(ts2)## Model is being refit with current smoothing parameters but initial states are being re-estimated.

## Set 'use.initial.values=TRUE' if you want to re-use existing initial values.

## Results of statistical testing

## Evidence of trend: TRUE (pval: 0)

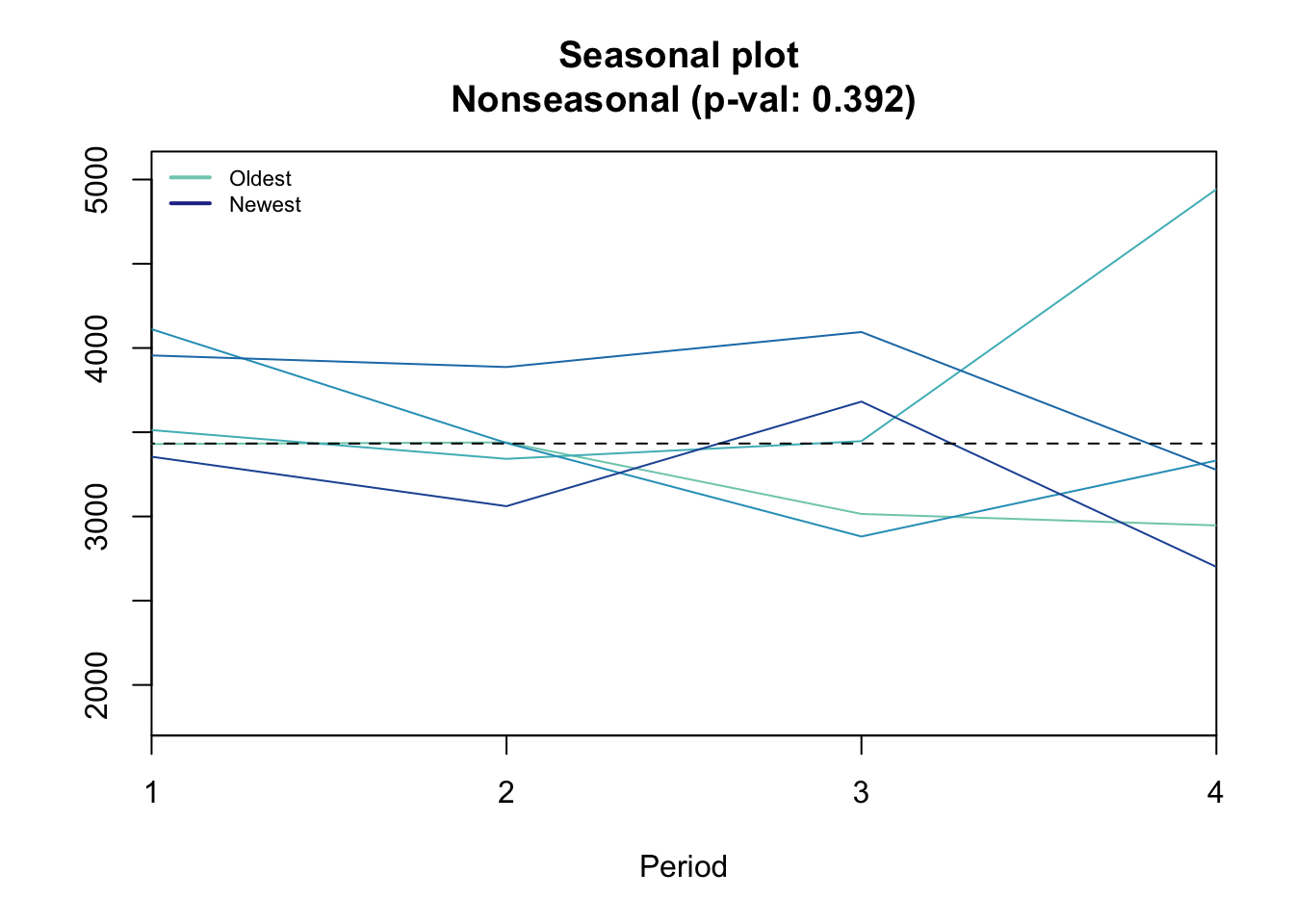

## Evidence of seasonality: TRUE (pval: 0)seasplot(ts1)## Model is being refit with current smoothing parameters but initial states are being re-estimated.

## Set 'use.initial.values=TRUE' if you want to re-use existing initial values.

## Results of statistical testing

## Evidence of trend: FALSE (pval: 0.623)

## Evidence of seasonality: FALSE (pval: 0.392)Addative vs Multiplicative

An argument in decompse. In the ts below we can that the seasonality grows as time goes on (ie the y components widens)

plot(ts2)

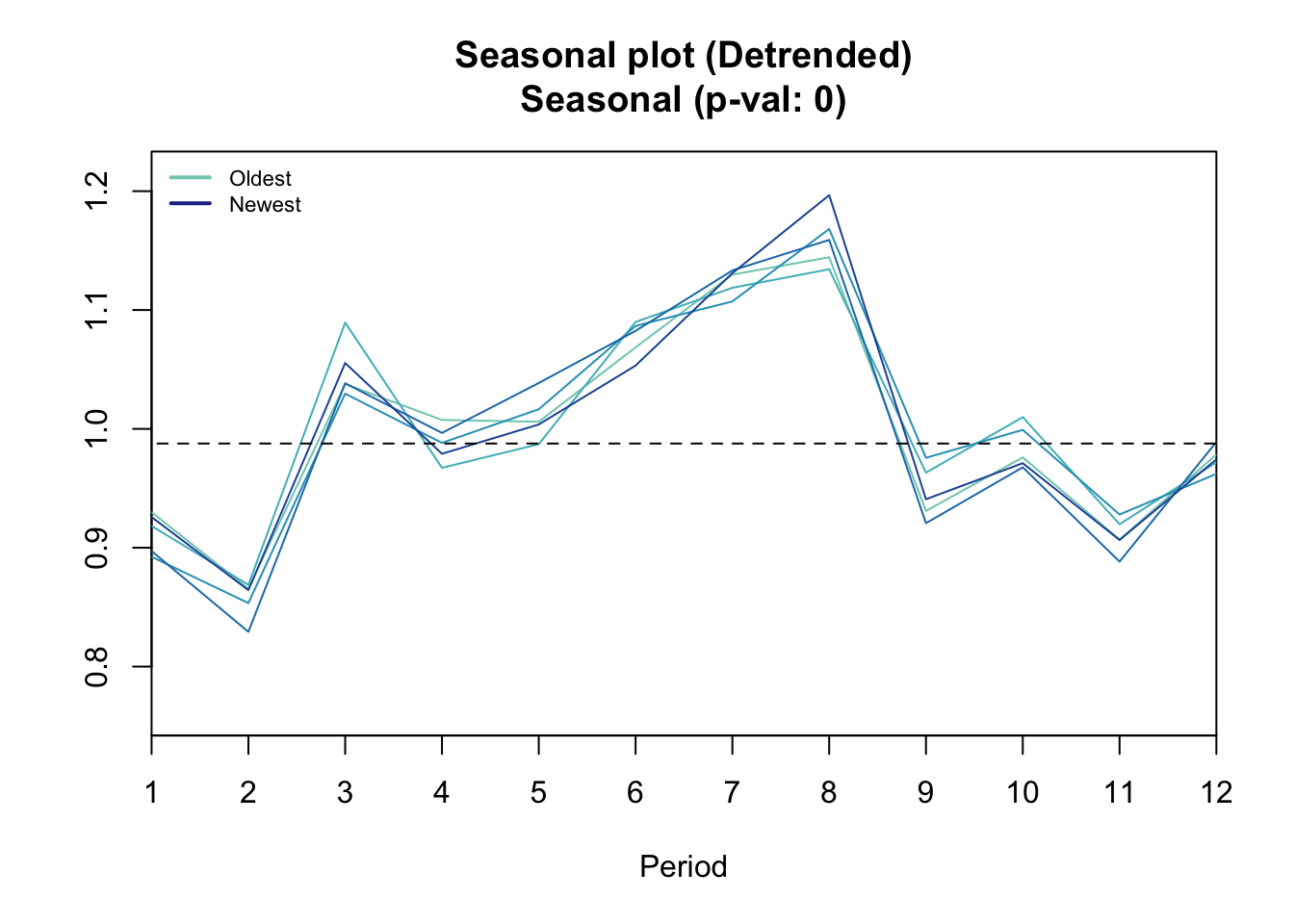

Seeing internal trends… (like two peaks)

seasplot(y,outplot=3)## Model is being refit with current smoothing parameters but initial states are being re-estimated.

## Set 'use.initial.values=TRUE' if you want to re-use existing initial values.

## Results of statistical testing

## Evidence of trend: TRUE (pval: 0)

## Evidence of seasonality: TRUE (pval: 0)Test in a moving average

Non-paramatric test don’t assume norm dist and hence are closer to realistic data…

coxstuart(cma)## $H

## [1] 1

##

## $p.value

## [1] 9.313226e-10

##

## $Htxt

## [1] "H1: There is trend (upwards or downwards)"Test seasonality

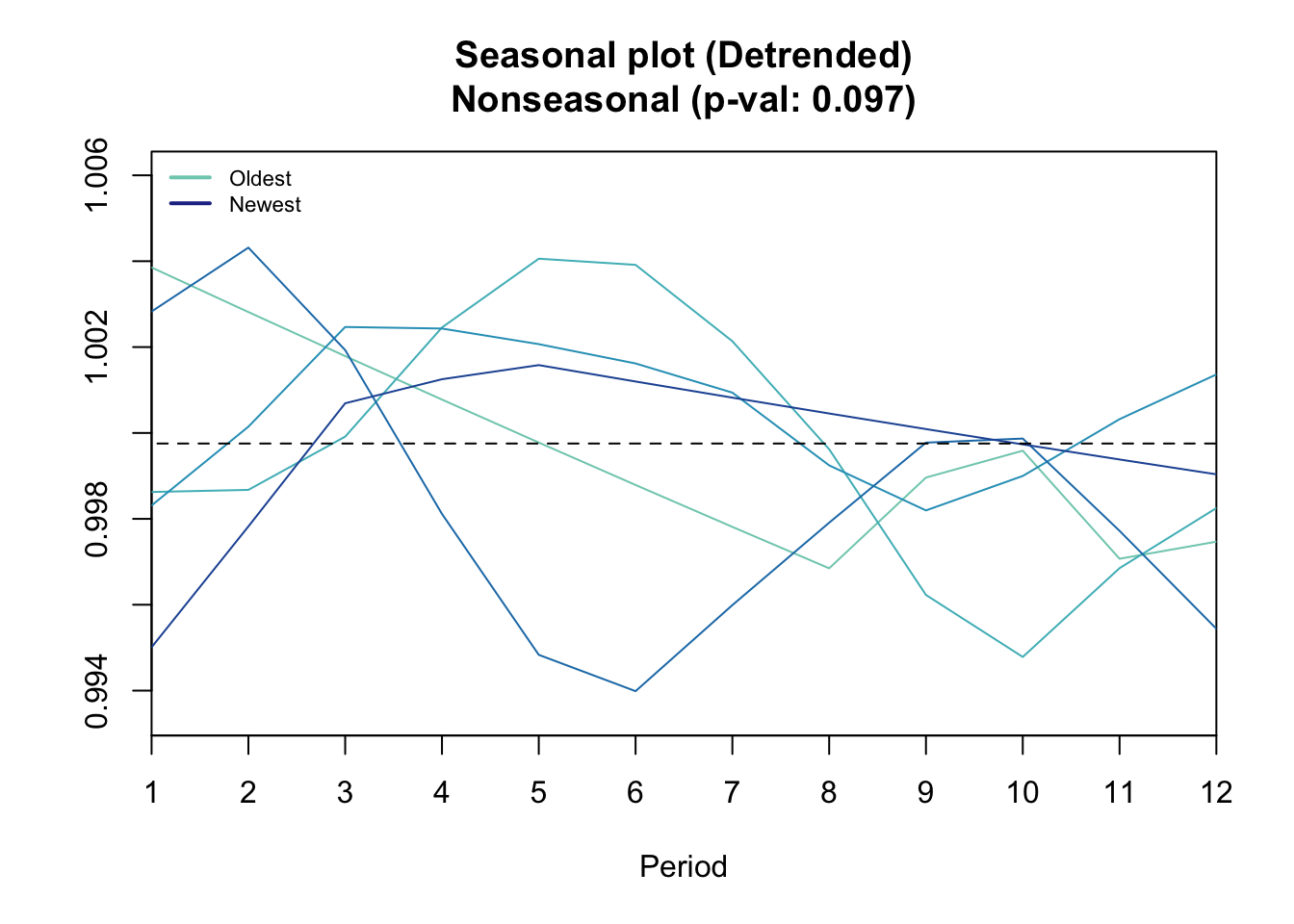

seasplot(cma)## Model is being refit with current smoothing parameters but initial states are being re-estimated.

## Set 'use.initial.values=TRUE' if you want to re-use existing initial values.

## Results of statistical testing

## Evidence of trend: TRUE (pval: 0)

## Evidence of seasonality: FALSE (pval: 0.097)seasplot(ts2)## Model is being refit with current smoothing parameters but initial states are being re-estimated.

## Set 'use.initial.values=TRUE' if you want to re-use existing initial values.

## Results of statistical testing

## Evidence of trend: TRUE (pval: 0)

## Evidence of seasonality: TRUE (pval: 0)Instead of acf pacf tests?

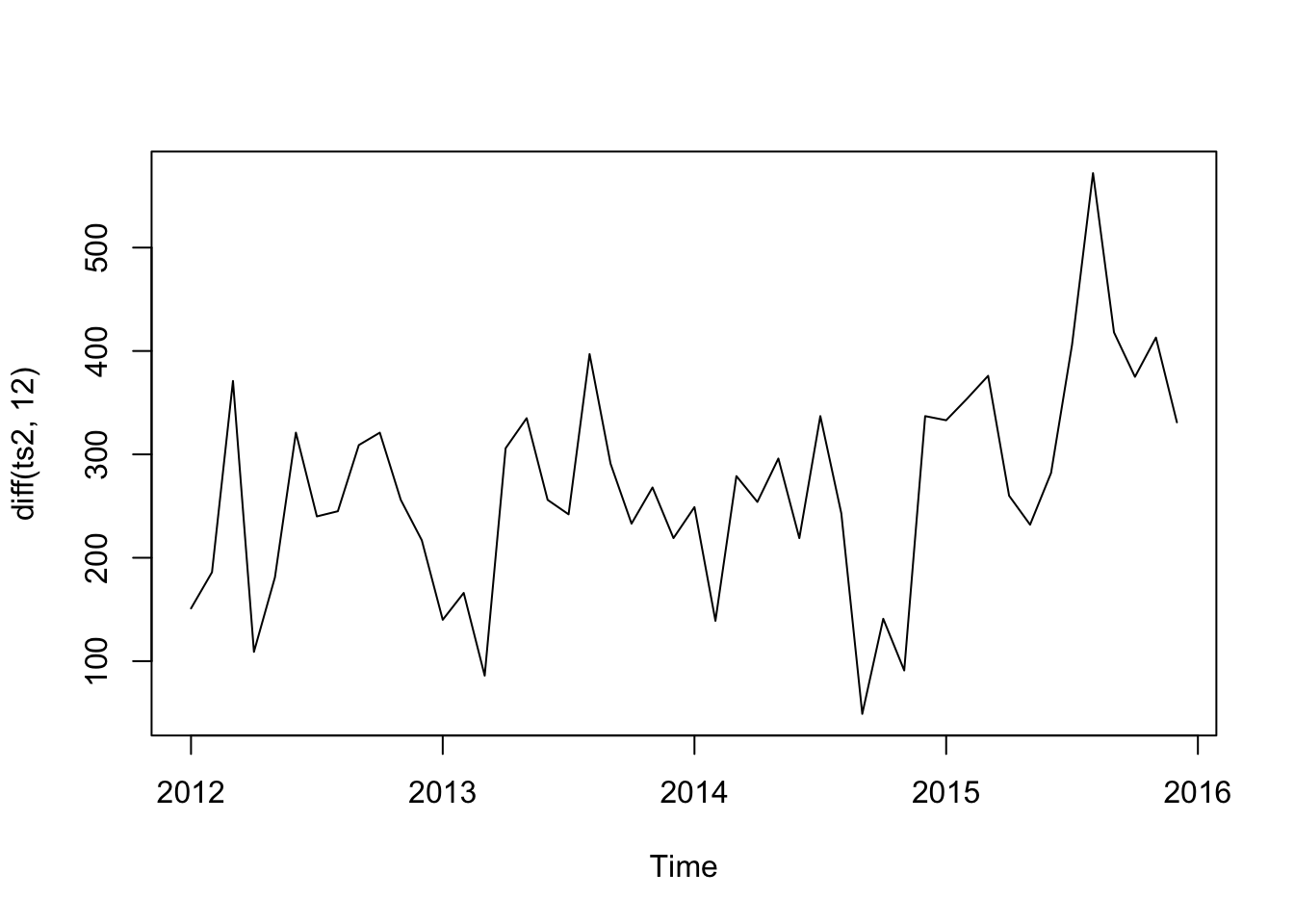

plot(diff(ts2, 12))

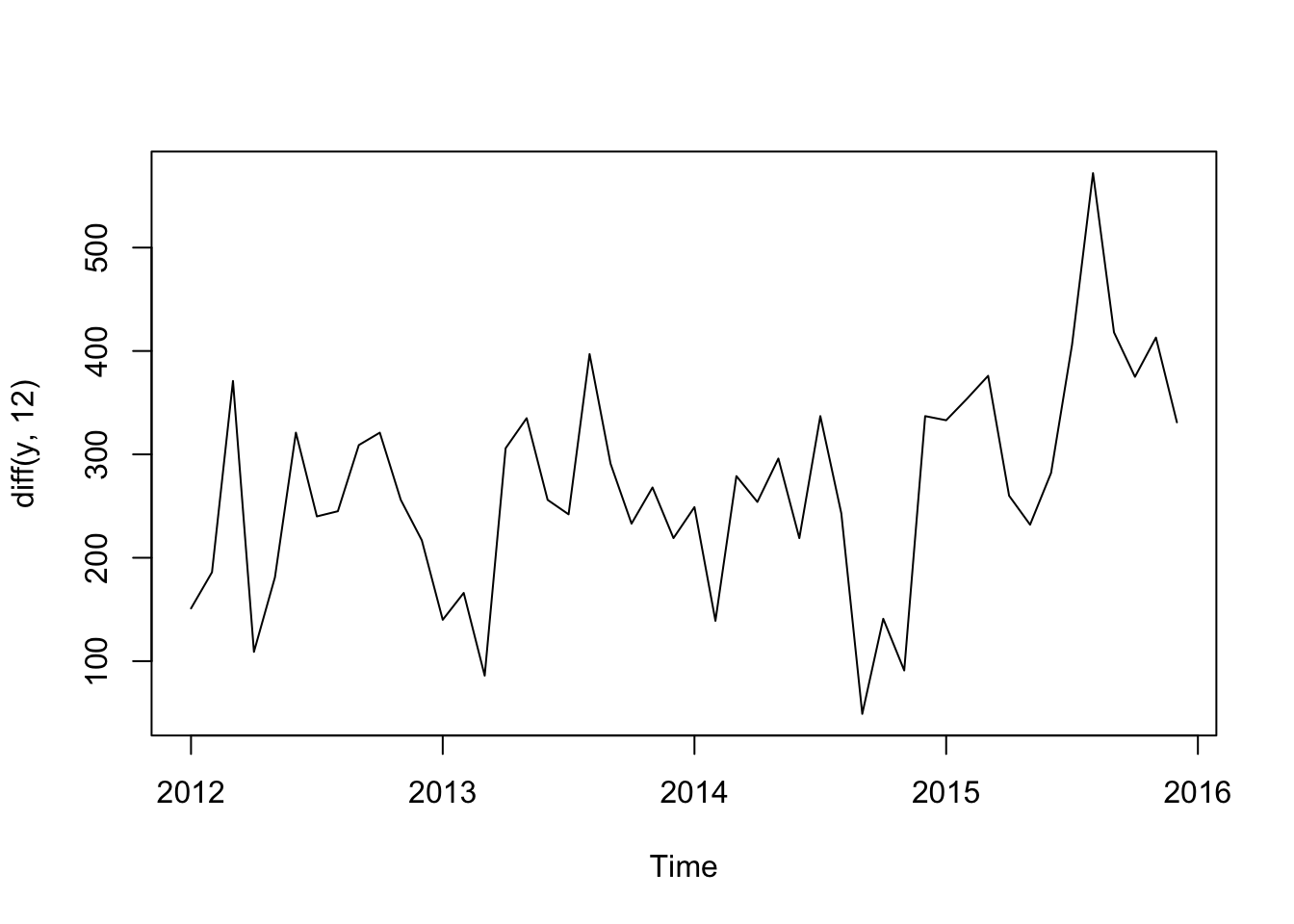

plot(diff(y, 12))

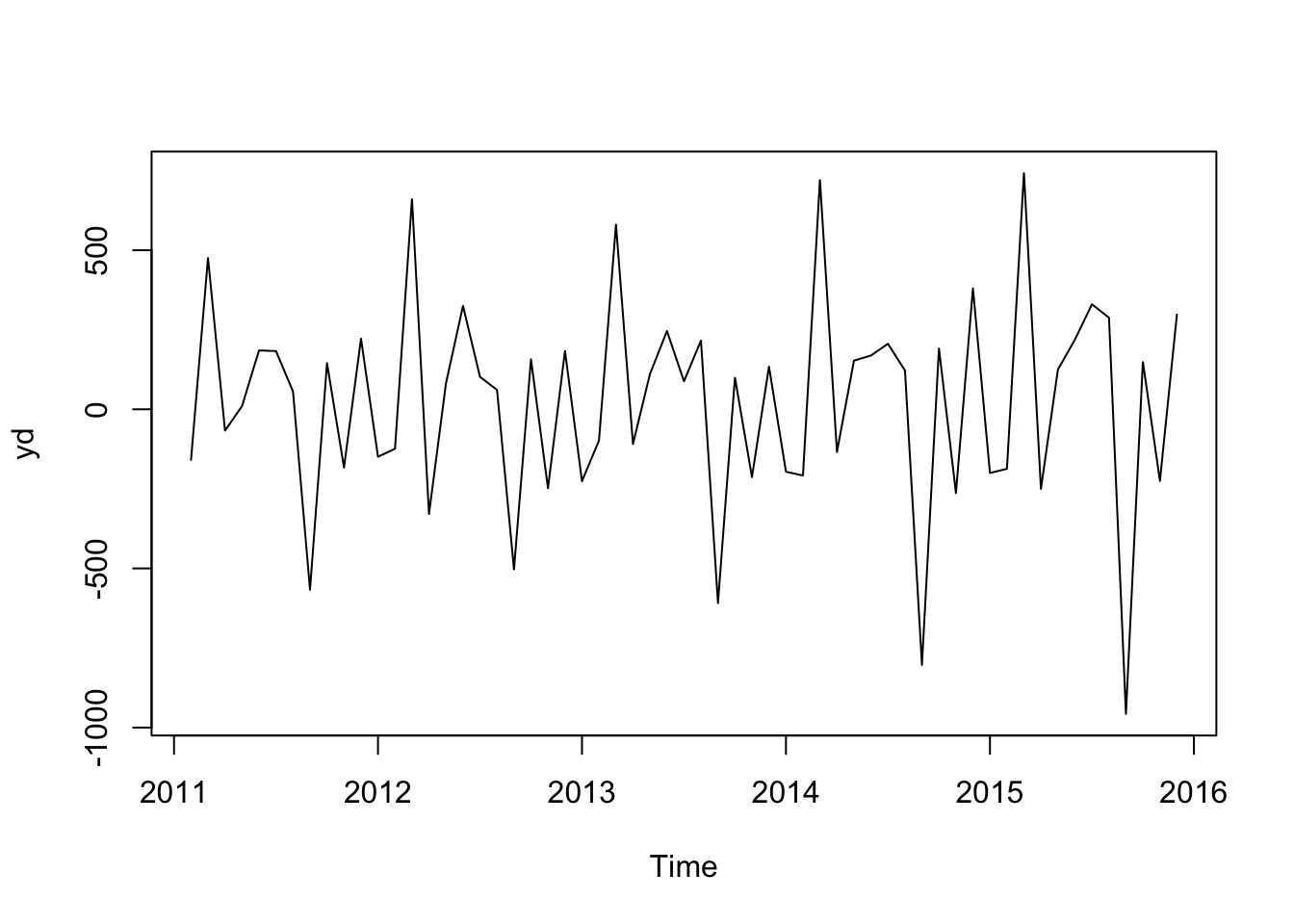

yd <- diff(y, 1)

plot(yd)

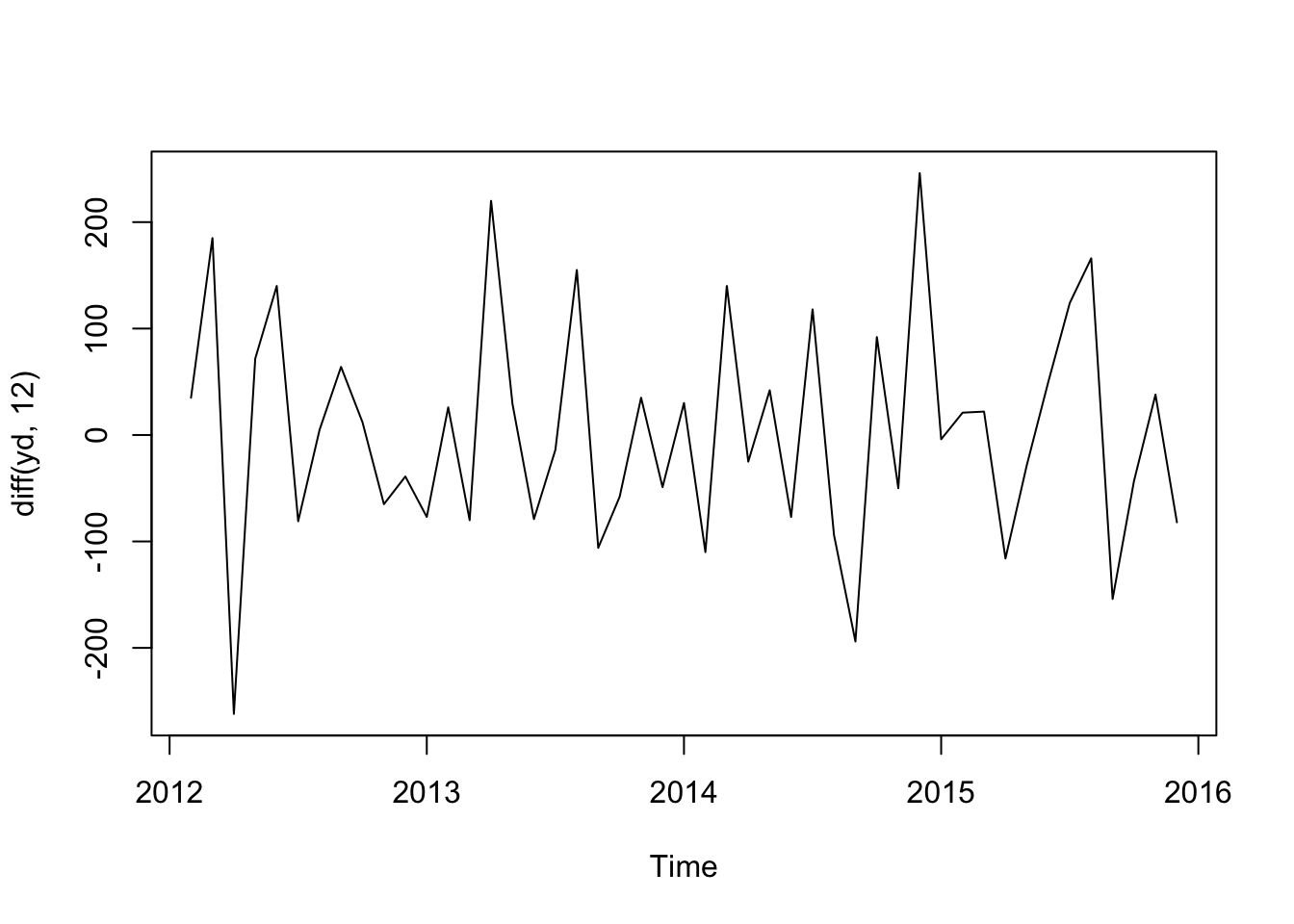

ydd <- plot(diff(yd, 12))

ydd## NULL